Solar power drives record low grid demand in New England

Demand on the ISO New England market hit a record low demand of about 5,320 MW in April, with solar and other non-emitting resources supplying over 80% of the region’s electricity at noon.

Demand on the ISO New England market hit a record low demand of about 5,320 MW in April, with solar and other non-emitting resources supplying over 80% of the region’s electricity at noon.

The expansion includes three new liquefaction trains, boosting the terminal’s production capacity by 19 mtpa.

The gas industry argues that the existing rules have been exploited as a tool by project opponents to unfairly delay infrastructure development.

ArcLight aims for full ownership of the 464-MW Middletown Energy Center in Ohio.

The deal would see ArcLight acquire a 25% stake in the 475-MW North Carolina natural gas plant.

The appeal challenges FERC’s acceptance of PJM’s tariff revisions, establishing a fast-track process for certain generation projects to address resource adequacy concerns.

The 4,600 MWh Darden Clean Energy Project battery system, paired with a 1,150 MW solar facility, marks a milestone in California’s market.

Q-Generation’s assets include power plants in ISO New England, ERCOT, and PJM.

Innergex Renewable Energy’s U.S. portfolio includes assets in PJM, WACM, and NYISO.

The project is intended to diversify the LNG terminal’s feed gas sources.

The grid expansion is part of a larger portfolio of transmission projects aimed at adding nearly 29 GW of new generating capacity along the MISO-SPP seam.

The market monitor says the proposal would remove incentives for replacement capacity, potentially impacting reliability and raising costs for consumers.

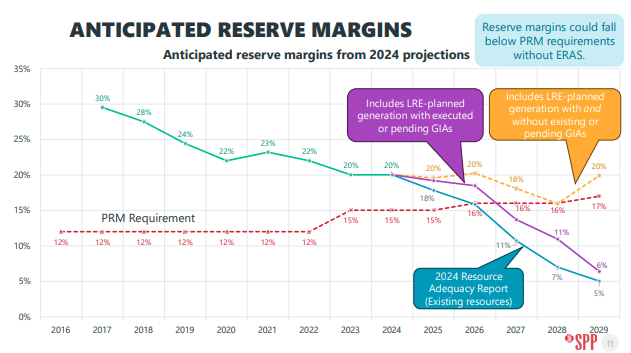

The plant is needed to help plug a projected resource adequacy shortfall expected to reach nearly 1.2 GW by 2029.

The revised proposal includes a project cap, stricter requirements for demonstrating need, and accommodates retail choice states, aiming to accelerate generation projects to meet resource adequacy needs.

The proposed change aims to streamline the interconnection of commercially ready projects in both RTO footprints, addressing urgent capacity needs.

Policy aims to mitigate customer financial risk from catastrophic wildfires potentially linked to utility equipment.

SparkWire’s Power Project & PPA Roundup, compiling in-service dates and power purchase agreements for renewable and fossil generators, for the two weeks ended June 6.

The change aims to streamline interconnection procedures and reduce delays for new generation projects along the MISO-SPP seam.

Amendment aims to establish a 200 MW ceiling on exchanges, doubling the current limit.

High natural gas prices, driven by increased heating demand, pushed wholesale electricity costs up 116% compared to winter 2024.

ITC’s proposed portfolio of projects are part of a larger multi-billion-dollar grid expansion across the region intended to bolster grid resiliency and enhance renewable integration.

The deal aims to ensure reliable power for Amazon’s growing Ohio data center operations while protecting AES Ohio customers.

The deal would mark Partners Group’s entry into the ISO New England wholesale power market.

The new process aims to address backlog of connection requests by considering planned generation resources.

Inquiry follows reports of potential “backdoors” and “kill switches” in Chinese-made solar, wind, and battery inverters.

PJM must revise its interconnection agreements to explicitly assign land acquisition duties for network upgrades to transmission owners, not customers.

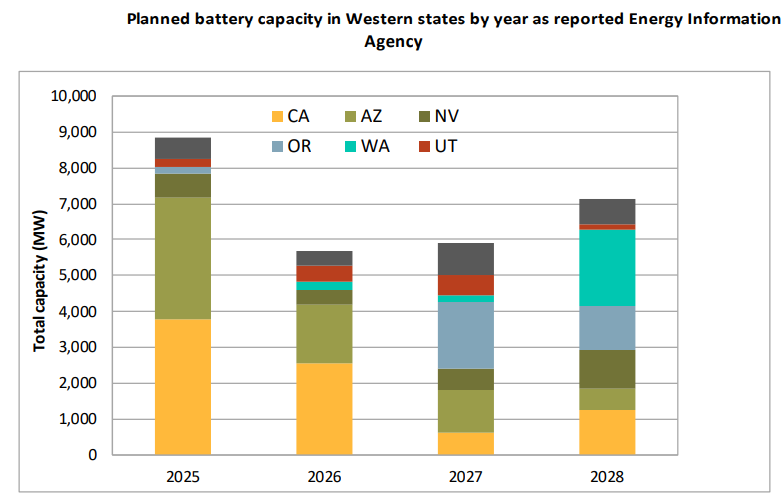

California, by far the nation’s largest market for battery storage, is expected to see project growth fall over the next four years, with other Western states posting stronger numbers, a new report shows.

IGS expands retail footprint through merger with Just Energy’s U.S. subsidiaries.

The deal marks the Canadian company’s entry into the PJM market.

The project, a middle segment of the larger North Rochester – Columbia line, aims to enhance reliability and reduce congestion in Minnesota and Wisconsin.

The complaint alleges that indicated energy efficiency sellers lack evidence to support payments for the 2025/2026 capacity market delivery year.

The request sites Trump’s executive order for energy abundance, strong market demand, and the need for enhanced reliability.

The decision hinges on Sayreville reaching an emissions offset agreement with the state of New Jersey before Sept. 1.

The decisions enable two mothballed power plants totaling over 300-MW of capacity to potentially return to service in PJM, addressing capacity needs.

The transaction involves the transfer of ownership of various natural gas-fired power plants, battery storage systems, and power marketing entities.

Shifting fuel mix sees solar, storage, and hybrid or thermal projects dominate interconnection queue, surpassing wind.

SPP projects a 17 GW capacity shortfall by 2030, necessitating the accelerated study and integration of new projects to meet resource adequacy and reliability needs.

Canadian investor gains 25% ownership in 845 MW Oregon wind farm.

CalGrid asks FERC to expedite its decision on rate incentives crucial for mitigating risks for two California transmission projects designed to integrate floating offshore wind projects.

The acquisition follows the launch of the Jain Global hedge fund last year, in which it raised $5.3 billion from investors.

The market monitor challenges the merger’s market power analysis, citing insufficient assessment of transmission constraints and dynamic submarkets.

The Houston-based developer asserts that FERC staff overstepped their authority in the draft review, citing recent executive orders.

Colonial Pipeline asserts its proposed tariff revisions will enhance capacity and safety, mitigating alleged system stress.

GenOn Holdings Inc. faces FERC penalties for inaccurate energy market offers in PJM Interconnection.

Nineteen states and two organizations challenge FERC’s decision, claiming BlackRock’s participation in climate initiatives violate its passive investor status.

SparkWire’s Power Project & PPA Roundup, compiling in-service dates and power purchase agreements for renewable and fossil generators, for the week-ended May 16, 2025.

The deal comes ahead of Apollo’s move to acquire another 2.3 GW of gas-fired and hydro assets.

The joint venture helps streamline the interconnection process, optimizing resource utilization for the developers which face long PJM project queues.

Holtec’s planned commercial operation date for the reactor is “as soon as” later this year, providing some wiggle room for the generator’s re-start.

The $28B LNG project awaits a final FERC nod as the U.S. Energy Information Administration forecasts continued strong global demand for LNG this year.

The challengers highlight that ANR’s proposed return on equity of 14.54% is 300 basis points higher than FERC’s most recently litigated ROE.

Distribution, transmission, and state policies identified as major contributors, challenging assumptions about PJM’s recent record capacity auction.

FERC authorization is requested for sales in the Northwest, CAISO, and BANC markets, rectifying inadvertent sales outside current tariff regions.

FERC Chairman Mark Christie emphasized the unsustainable pace of dispatchable generation retirements and the need for additional capacity.

The split decision seeks to strike a balance between incentivizing transmission development with consumer protection, setting a potential precedent for future projects.

The FERC approval comes amidst a broader inquiry by the agency into PJM’s handling of co-located loads and their impact on the transmission system.

The request aims to align the in-service date with an updated construction schedule following the Tellurian acquisition.

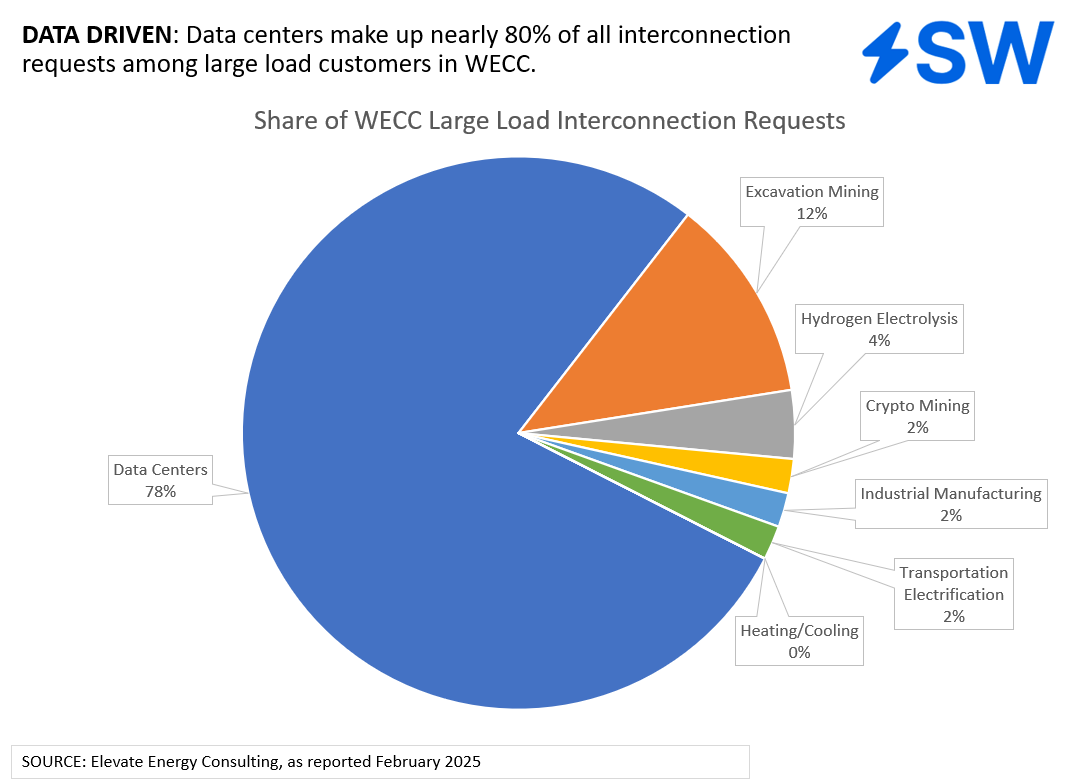

Data centers in the Western Interconnection are dominating the grid connection queues, accounting for nearly 80% of total requests from large load customers.

The DOI argues that Order No. 871’s automatic stay provision now hinders energy infrastructure development, contradicting current federal policy.

SparkWire’s Power Project & PPA Roundup, compiling in-service dates and power purchase agreements for renewable and fossil generators, for the week-ended May 9.

The results of the review reaffirms the agency’s original findings of no significant impacts, paving the way for a final decision on the project.

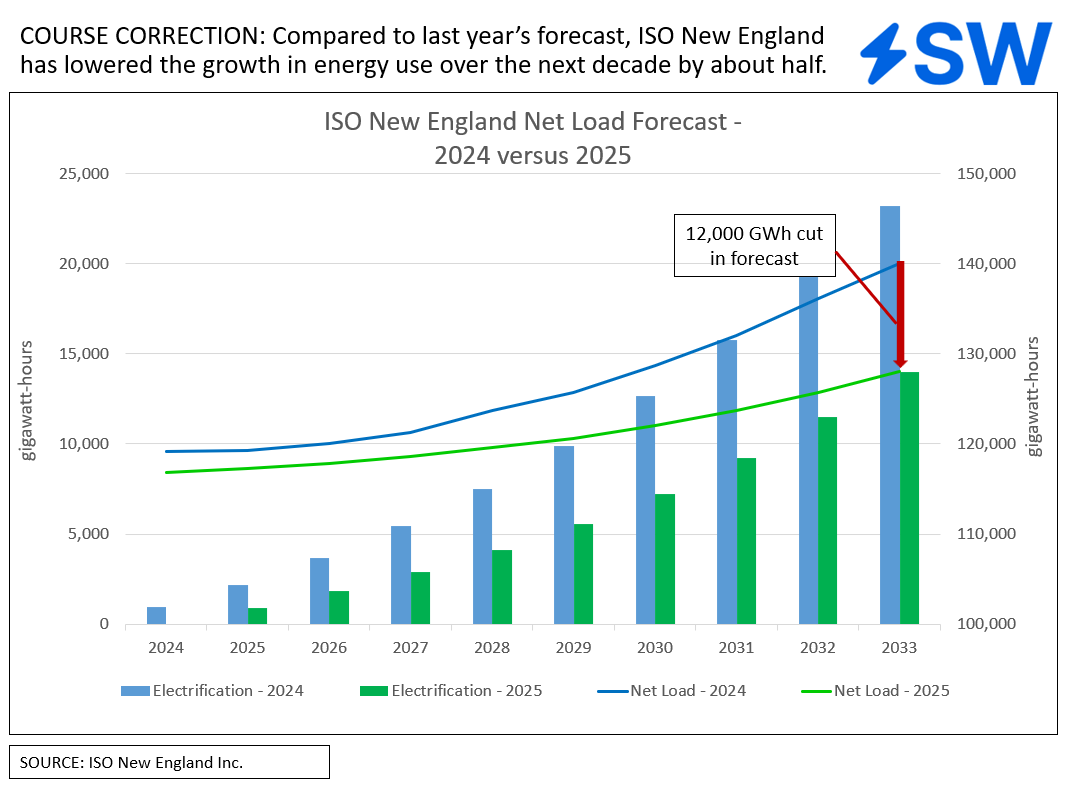

Projected energy demand from electric vehicles and heating electrification are 47% lower in 2030 than the prior year forecast.

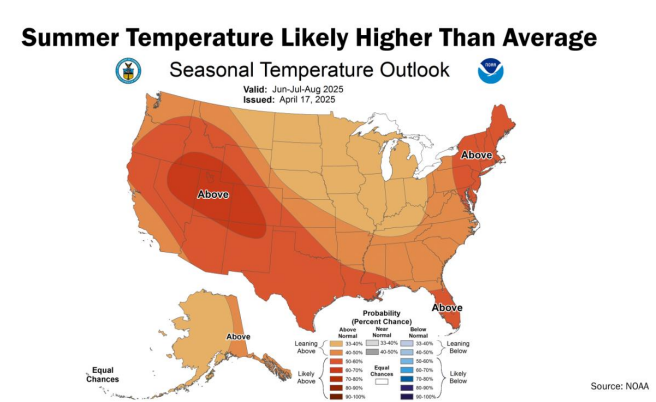

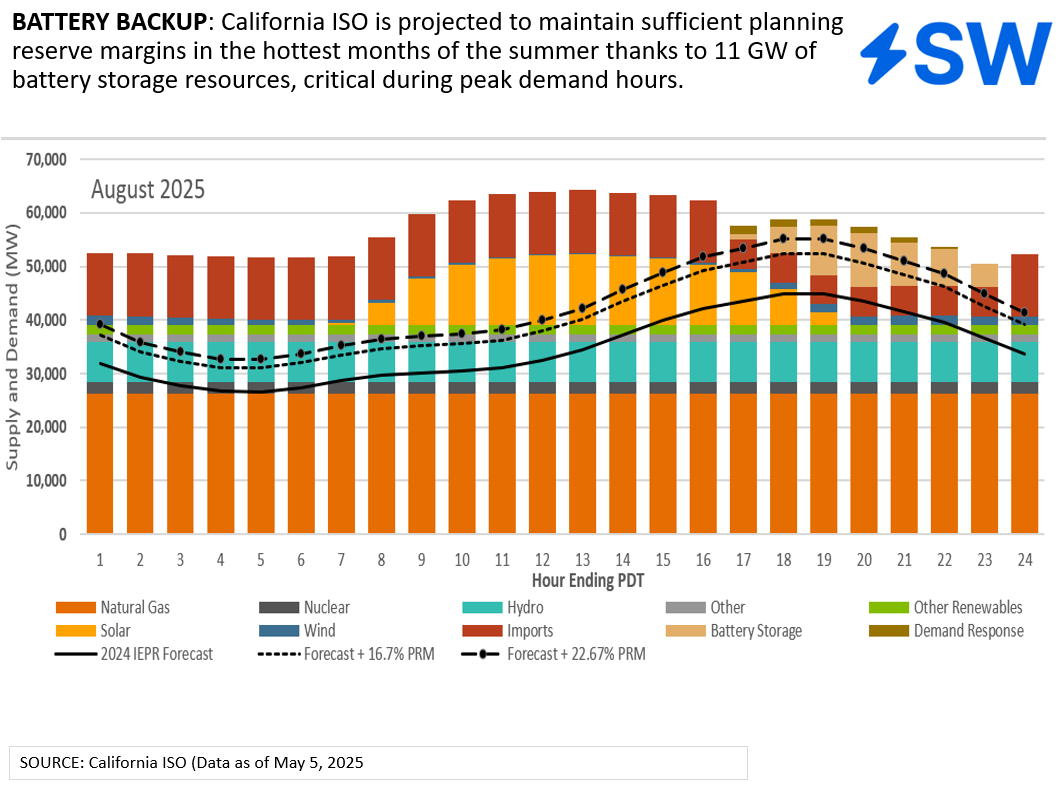

Larger capacity reserves and over 11 GW of battery storage resources are putting the California grid manager on stronger footing as it faces a warmer-than-normal summer.

The new rules come as PJM found that more than 20% of loss of load risk occurs in hours outside of the current demand resource availability windows.

The requested increase in workers is said to be needed in order for the timely commissioning of three LNG trains expected to enter commercial service later this year.

Otter Tail Power’s transmission investments are part of a grid upgrade spanning the Dakotas and Minnesota, estimated to cost $2.58 billion.

The settlement calls for Talen’s generators to bid into PJM’s capacity market, with any revenues to offset customer costs.

BofA’s acquisition makes it a top GenOn owner, alongside distressed debt and private equity investor Strategic Value Partners and investment management firm MacKay Shields.

The termination follows a three-year suspension and a failure by Cat Creek to provide the required construction deposit.

The purchase advances the Texas-based retail electric service provider’s plans to expand into other markets.

The deal strengthens Repsol’s position in California’s energy storage market and moves it closer to its goal of reaching over 2 GW of U.S. assets by 2025.

The acquisition would expand NextEra’s retail presence in half a dozen states spanning across the Eastern U.S. including New York, Ohio, and Florida.

The proposed deal comes right on the heels of a sale of a New Jersey gas plant by Ares Management.

SparkWire’s Power Project & PPA Roundup, tracking renewable and fossil generator project updates and PPA terms filed with FERC for the week-ended May 2.

Settlement with FERC establishes a 10.55% base return on equity for the transmission developer.

One area where many stakeholders find agreement on co-location policies – the need for clearer rules from PJM.

East Tennessee’s capital investments since its last rate case represent over 30% of the total gas plant value, while operating and maintenance expenses have also soared 30%.

RMI champions co-locating data centers with gas generators and renewables to boost grid reliability and cut emissions.

The petition challenges FERC’s decision to apply a revised ROE methodology retroactively, impacting refunds and potentially setting a precedent for future rate cases.

Virginia’s data center boom is sparking a heated interstate dispute over how to assign costs for billions of dollars in grid upgrades.

SparkWire’s Project & PPA Roundup, tracking project details, updates and PPA terms filed with FERC for the week-ended April 25.

Golden Pass LNG’s permit modification request follows Venture Global LNG’s similar action for its Louisiana terminal.

The Electric Power Supply Association, PJM Power Providers Group, and several generation companies are stepping up their opposition to PJM’s rules on the co-location of load.

The decision establishes a temporary price cap and floor for 2026/2027 and 2027/2028 delivery years, aiming to balance market stability and consumer protection amid rapid load growth and resource retirements.

Tucson Electric, UNS Electric, and UniSource face scrutiny over market-based rates after failing market share tests.

FERC’s ruling may facilitate similar production boosts at other LNG plants.

Strategic Value Partners will co-own the Pennsylvania generator alongside a group of Japanese energy companies, led by Tokyo Gas Co., Ltd. and Sojitz Corp.

The agreements by Avangrid and the New England system operator are intended to make way for trial operations of the project in September.

Company cites COVID-19 pandemic, shifting LNG markets, and Energy Transfer’s takeover as reasons for the delay.

LSP Digital’s proposal to shift Doswell Generating Station’s capacity to a behind-the-meter data center faces opposition from the PJM Independent Market Monitor.

Rehearing requests were denied for plan to accelerate grid connection for shovel-ready projects, despite concerns from clean energy sector.

The proposal would reduce capacity resource deficiency charges to 100% of a resource’s clearing price, shielding sellers from penalties due to lower calculated reliability benefits.

MISO’s proposed changes aim to enhance market protections against manipulation and fraud through stricter standards for demand response resources.

Canadian imports have served approximately 11% of New England’s load, on average, over the past five years.

EEI argues that inflexible reliability standards could jeopardize grid reliability by sidelining needed generation capacity during a period of increasing electricity demand.

The 880-MW Frontier Generating Station is strategically connected to ERCOT and MISO.

Despite protests citing potential conflicts of interest, FERC renewed BlackRock’s ability to acquire up to 20% of voting securities in U.S. traded utilities.

Exorbitant price increases in PJM’s latest capacity auction are projected to cost New Jersey ratepayers $1.7 billion, prompting calls for the investigation.