Solar power drives record low grid demand in New England

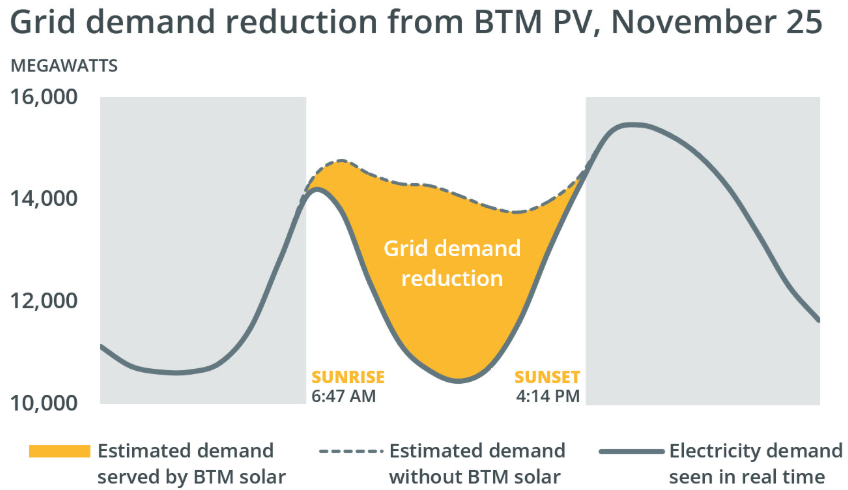

Demand on the ISO New England market hit a record low demand of about 5,320 MW in April, with solar and other non-emitting resources supplying over 80% of the region’s electricity at noon.

Demand on the ISO New England market hit a record low demand of about 5,320 MW in April, with solar and other non-emitting resources supplying over 80% of the region’s electricity at noon.

Q-Generation’s assets include power plants in ISO New England, ERCOT, and PJM.

High natural gas prices, driven by increased heating demand, pushed wholesale electricity costs up 116% compared to winter 2024.

The deal would mark Partners Group’s entry into the ISO New England wholesale power market.

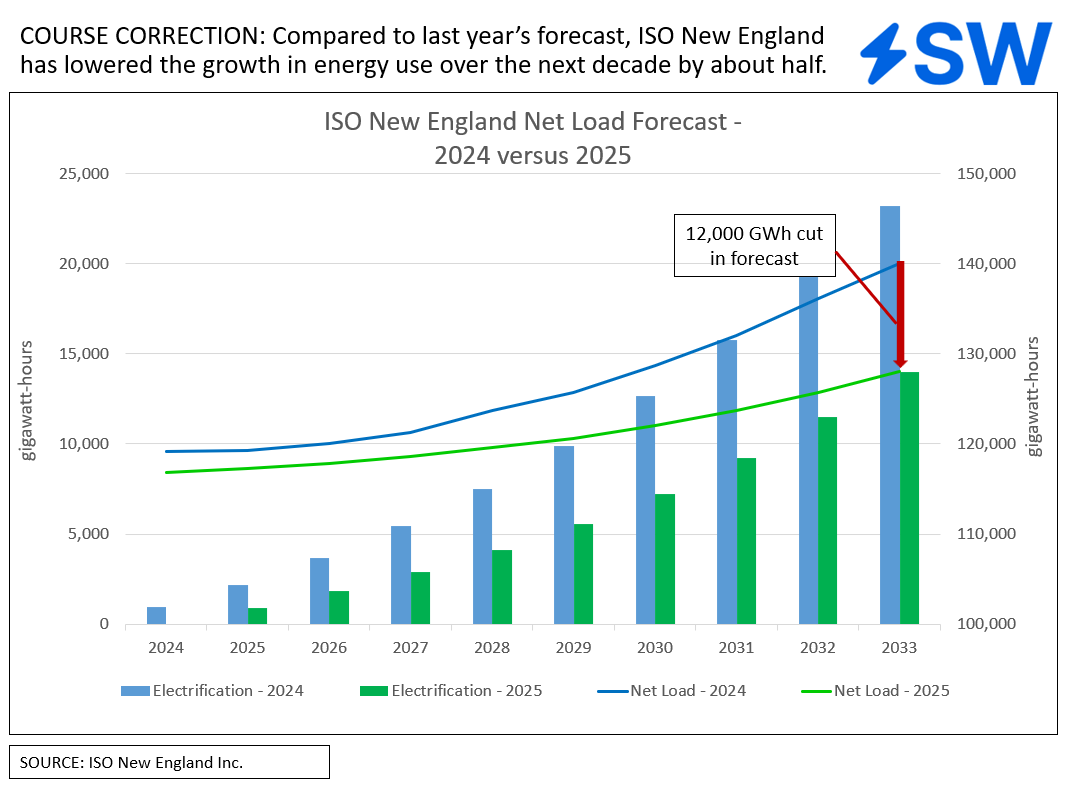

Projected energy demand from electric vehicles and heating electrification are 47% lower in 2030 than the prior year forecast.

The agreements by Avangrid and the New England system operator are intended to make way for trial operations of the project in September.

Canadian imports have served approximately 11% of New England’s load, on average, over the past five years.

The grid operator’s latest load forecast projects 3.4% lower peak winter demand this year than previously forecasted, with the difference increasing to 5.5% by 2030.

Williams’ indirect stake in Q-Generation has triggered the FERC review of the board seat.

The new tariffs enable standalone battery storage systems to participate in ISO New England’s wholesale markets.

The order approves revised interconnection procedures, timelines, cost allocation methods, and financial security requirements for generators connecting to the New England grid, aiming to streamline the process while addressing a backlog of interconnection requests.

The advocacy group argues that ISOs lack the legal authority to collect tariffs, which are the responsibility of U.S. Customs and Border Protection.

Further delays in the approval of the market reforms could leave up to 3 GW of new resources ineligible for the next capacity commitment period, according to one estimate.

The decision represents a key step in the advancement of the project, designed to help integrate 4,800 MW of offshore wind power for the six-state region.

The acquisition expands investors’ generation portfolio spanning Massachusetts and New York.